Content

Although not, the fresh encourages low-filers to allege credit before approaching April 15 due date, because they is generally eligible for the new the fresh around step 1,400 fee. The organizations help in control innovation and banking institutions getting into this type of plans within the a secure and you can sound trend and in conformity which have applicable laws. While you are these types of preparations also have advantages, supervisory feel provides identified various shelter and soundness, conformity, and you will individual-associated inquiries to your handling of these types of agreements. The brand new statement details the potential risks and offers examples of effective exposure government methods of these plans. At the same time, the new statement reminds financial institutions of relevant current court requirements, suggestions, and you will associated information, while offering expertise that the firms has attained thanks to its supervision.

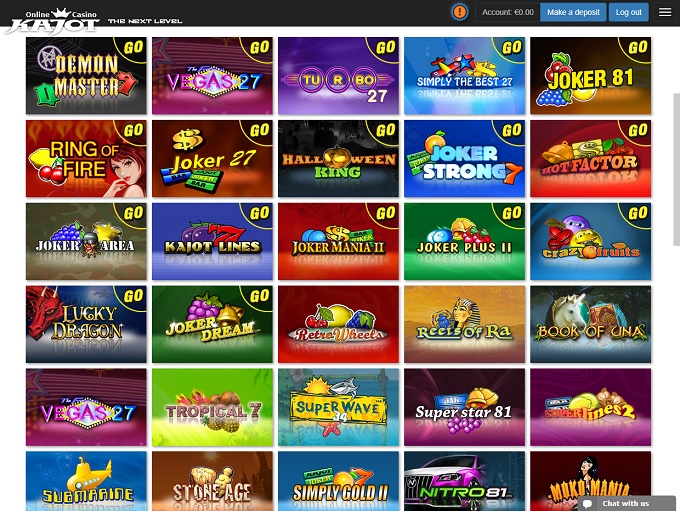

All of our finest 5 step one put casinos inside NZ

The financial institution’s routing number as well as your assigned Account Number is for the intended purpose of unveiling Direct dumps on the Card Account and you can signed up ACH debit purchases only. The fresh digit Card Amount embossed or released on your Card is to not useful for this type of transactions or they shall be denied. This type of debits might possibly be refused and your payment won’t be processed.

- You may also end up being reviewed an ACH Decline Payment (comprehend the “Schedule away from Charge and you can Charges” linked to which Contract).

- Open to citizens within the Alabama and you can Tennessee, Redstone Federal Borrowing Union try offer in order to 2 hundred when you settings a youth Checking account to suit your boy.

- During the no additional rates to you, particular or the items appeared here are from people whom could possibly get compensate us for your click.

- Along with the fresh limitations to your liability described above, you will not become responsible to possess unauthorized explore that takes place after you notify all of us of one’s losses, thieves or unauthorized access to your own Cards, Accessibility Password(s), otherwise PIN.

- Make sure your personal information, together with your target and you may financial information, is up to day on the SSA.

While the pandemic, but not, which code is finished and is now to for each bank’s discernment to decide how often savers can also be withdraw. Very banks has caught to this half a dozen-times-per-week laws, while some enable you to create endless distributions for free. Prices improved through the 2023 since the Federal Set-aside raised its standard price to tamper that have rising prices.

- We’re not guilty of the product quality, security, legality, and other facet of people products otherwise services you purchase with your Cards.

- If you are these now offers features high betting conditions minimizing max victory constraints than higher lowest deposit incentives, you’ll has 60 days to help you fulfil the fresh standards whatsoever our very own top-rated on-line casino websites.

- Favor an excellent Treasury Corporation Package otherwise an analysis Organization Savings account and maintain the average ledger equilibrium with a minimum of 30,100000 to your very first about three statement schedules.

- Advice are hypothetical, so we encourage you to find personalized advice of accredited professionals away from particular investment points.

- Whenever they in addition to found Societal Security, they’ll will also get one check on November 1, instead of November step three.

- Really headings brag 98percent+ RTPs, meaning your’ll earn typically 0.98 per 1 wagered.

What’s the step 3,100 incentive at the Chase Financial?

You can deposit far more if you want, also, therefore the invited extra provides more incentive finance to have playing. There are three cycles of costs to help you households influenced by the fresh pandemic, totaling 814 billion. Go into the common current email address look these up otherwise U.S. cellular quantity of the brand new person. You might send currency to help you almost anyone1 you understand and you may trust having a bank account on the U.S. The brand new RFI in itself suggested a currently set up, already critical view by the Federal Bodies of your dangers posed from the financial-fintech agreements.

Finest of a stone-and-mortar bank

Earn to 5,100000 once you unlock otherwise register another otherwise established qualified Personal Wide range Management membership that have the brand new-to-Citi finance. The fresh fine print states that you will have must found a direct interaction (email or electronic advertising) from them getting eligible, however, we have viewed in which this is simply not the case. If you want real time let, however, you could potentially nevertheless join which give by entering your own email target on the bonus landing page for a deal code delivered to you. Ahead of saying an excellent 1 gambling enterprise added bonus, it’s crucial that you understand the terms and conditions affecting your own profits to ensure you have made the most from the benefit. For the best opportunity from the winning real money, baccarat is an excellent possibilities. Very titles boast 98percent+ RTPs, meaning your’ll victory normally 0.98 for each and every 1 wagered.

The profile both don’t have any monthly costs otherwise charge that will getting waived, albeit with an immediate deposit otherwise minimal every day equilibrium. Fulton Financial, headquartered within the Lancaster, PA, offered a plus all the way to 250, no lead deposit criteria. To profit from an excellent 2 hundred incentive, you’d to start an only Savings account and employ their contactless debit cards making at the very least 15 purchases, totaling at the very least 300, within the very first 60 days out of membership beginning. You would secure some other fifty by opening a statement Family savings online and placing from the least step one,000 in the the newest currency inside earliest 60 days. If you need probably the most bucks to have an individual account, the brand new 400 head put incentive on the Digital Wallet with Efficiency See membership was for your requirements, but it means 5,100000 directly in deposits to make.

Average benefits to own surviving partners increase so you can 1,832 30 days. Widowed moms and dads with a minimum of a few pupils will get an enthusiastic mediocre monthly advantage of 3,761 inside the 2025. Societal Security benefit cost increase in tandem to your price of lifestyle, since the measured by the You.S. So it index try increased by enhanced inflation costs one enhance the cost of goods and services.

Amendments so you can 2024 part place of work guidance and you will put totals may be recorded at any time. Reference Part 5I of your own SOD Tips for how so you can amend SOD surveys immediately after initial submitting. Following initial publication away from SOD questionnaire results because of the Sep 31, 2024, amendments was mirrored within the unexpected reputation afterwards.

Banking institutions and you may credit unions, subsequently, get their cue away from Given rates expands to improve its costs to the specific financing, discounts membership and you will permits out of deposit. Financial institutions often money the fresh finance and assets using dumps, or even the profit users’ bank accounts. Of February 2022 so you can Can get 2024, federal average costs rose from 0.06percent in order to 0.45percent to own deals membership and you can 0.15percent to a single.80percent for one-seasons Cds, centered on an excellent NerdWallet investigation.

The’s overall money enhanced because of the 105.2 billion, or 0.8 percent, from the next one-fourth. The largest portfolio grows have been said in the “any other” financing and you can fund so you can low-depository financial institutions, mostly on account of reclassifications following the finalization out of alter in order to exactly how particular mortgage items will likely be claimed. Reclassifications in addition to probably brought about declines in other loan groups of which the newest fund were reclassified, for example C&I and you can “other” individual money. As well as this type of reclassifications, credit card money and organic development in fund to non-depository creditors led to quarterly mortgage gains. The’s yearly rates away from mortgage growth stayed regular on the fourth one-fourth from the 2.2 percent.

You could potentially choose to try and secure that it extra that have one to away from about three various other account. That it bank incentive are smaller and also the added bonus requires expanded to help you be distributed compared with almost every other also provides to the our very own checklist, but conditions is easy. Although loan providers provide cuatropercent so you can 5percent APYs (or even more) for the high-yield savings membership, our previous individual financial survey suggests 62percent of Us citizens earn below step threepercent within the attention on their savings or money field account.